A Flexible Way to Borrow

Get a Personal Line of Credit Between

$500 – $5,000

Apply in 45 seconds to see if you qualify

4.9/5 star reviews

Thousands of happy customers nationwide!

Same Business Day Funding. Quick and Easy Application Increased Credit Limit Based on Payment History. Unlike traditional online loans (such as installment loans), with a Line of Credit offered through Loyal Credit, you aren't required to borrow the entire amount you are approved for all at once. Access the money as needed, so long as you have available credit, your account is in good standing, and you otherwise meet any criteria required to request a draw from your account.

With a Line of Credit from a Bank Lending Partner through Loyal Credit, you can expect a fully transparent process.

Benefits of a Line of Credit

Draw as much or as little as you need:

You don’t need to draw your entire credit limit you’re approved for all at once. Request available funds when needed.

No final repayment date:

Unlike an installment loan, there is no set pay off date. Your Line of Credit remains available even if it’s paid off.

Pay it down, then borrow again:

You can make additional payments to pay down your Outstanding Principal Balance, making funds available to draw on again.

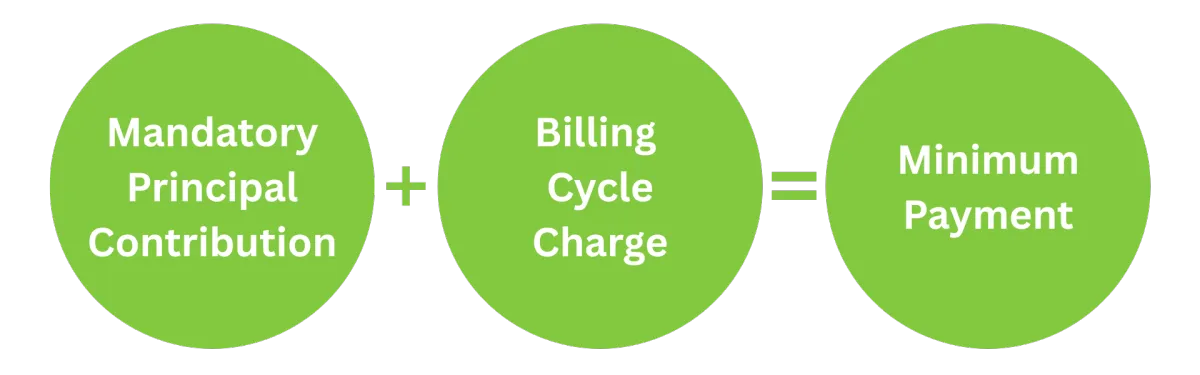

Payment Breakdown

If you have an Outstanding Balance, you’ll have to make Minimum Payments. Each Minimum Payment includes:

Minimum Payments can be due on a bi-weekly, semi-monthly or monthly basis, depending on your income frequency. The exact amount of each Minimum Payment will vary depending on your account activity. You will receive a periodic statement for each Billing Cycle with details including the amount of your upcoming Minimum Payment, your Due Date and other account information.

Billing Cycle Charge

Each Minimum Payment includes a Billing Cycle Charge, which is calculated based on your Average Daily Principal Balance for each Billing Cycle. The Average Daily Principal Balance is determined by adding the daily principal balance for each day in the billing cycle and dividing that sum by the total number of days in that billing cycle. See below for an example of a Billing Cycle Charge table.

Mandatory Principal Contribution

A portion of each Minimum Payment goes towards your principal balance. The Mandatory Principal Contribution will vary depending on your income frequency. Refer to your Line of Credit Agreement, or any amendments, for more details.

Making Extra Payments

There are no penalties for making extra payments above your Minimum Payments. In fact, it will help reduce your principal balance and also decrease the amount of Billing Cycle Charges over time, subject to your individual account activity. You can make additional payments by logging into your online account or by contacting us during our operational hours.

Cost of Credit Example

To demonstrate what is included in each Minimum Payment, let’s look at the following examples for monthly and non-monthly income frequencies. We assume in these examples that there is an outstanding principal balance of $1,500 for three billing cycles.

Monthly Income Frequency (each Minimum Payment is about 30 days apart):

| Billing Cycle Example | Average Daily Principal Balance | Mandatory Principal Contribution (A) | Billing Cycle Charge – Table 1 (B) | Minimum Payment Due (A+B) | Remaining Principal Balance |

|---|---|---|---|---|---|

| 1 | $1,500.00 | $30.00 | $184.00 | $214.00 | $1,470.00 |

| 2 | $1,470.00 | $29.40 | $184.00 | $213.40 | $1,440.60 |

| 3 | $1,440.60 | $28.81 | $184.00 | $212.81 | $1,411.79 |

Non-Monthly Income Frequency (each Minimum Payment is about 14 days apart):

| Billing Cycle Example | Average Daily Principal Balance | Mandatory Principal Contribution (A) | Billing Cycle Charge – Table 1 (B) | Minimum Payment Due (A+B) | Remaining Principal Balance |

|---|---|---|---|---|---|

| 1 | $1,500.00 | $15.00 | $85.00 | $100.00 | $1,485.00 |

| 2 | $1,485.00 | $14.85 | $85.00 | $99.85 | $1,470.15 |

| 3 | $1,470.15 | $14.70 | $85.00 | $99.70 | $1,455.45 |

Disclaimer: These are representative examples of the first three minimum payments. The examples assume a draw is made at the start of a billing cycle, only Minimum Payments are made and no additional draws are requested on the Line of Credit. This example is for illustrative and informational purposes only. The actual Minimum Payment(s) due on your Line of Credit may vary based on individual circumstances and will depend on your individual account activity. Continuing to only make Minimum Payments will take longer to pay down the Line of Credit. Additional payments are encouraged and payment in full is accepted, without penalty, at any time.

Billing Cycle Charge Table

Your Line of Credit Agreement, including any amendments, which can be found in your online account, will indicate the specific Billing Cycle Charges applicable to your Line of Credit. See below for an example of a Billing Cycle Charge table. Note that the Billing Cycle Charges may vary based on your individual qualifications*.

| If the "Average Daily Principal Balance" is: | Weekly / Bi-weekly / Semi-monthly Billing Cycle Charge | Monthly Billing Cycle Charge |

|---|---|---|

| $0.01 – $10.00 | $5.00 | $10.00 |

| $10.01 – $250.00 | $15.00 | $30.00 |

| $250.01 – $500.00 | $30.00 | $60.00 |

| $500.01 – $750.00 | $38.00 | $80.00 |

| $750.01 – $1,000.00 | $55.00 | $119.00 |

*You will receive a notice explaining how your credit score may impact the cost of your Line of Credit.

TESTIMONIALS

Happy Customers

"Customer Service was exceptional in letting me know how it works to draw more funds and what my payments would be. Plus, I love not having to re-apply for another loan if I need more money, just draw more out under the same loan."

- Susan

"What a great process, not only does this help me build up my credit score - the whole process was quick and easy - got the money I needed same day - the bonus, fees was not bad at all."

- Cynthia Boquet

"When I needed help, Loyal Credit was there for me. It's been an easy, pleasant experience dealing with the friendly people over at Loyal Credit. The whole process is easy and being able to get the money I need during unexpected occasions is a blessing. Thanks Loyal Credit!"

- Clayton

"This company came through for me when I was down and out. I needed help but everywhere I looked the door that was open, closed. Thankfully Loyal Credit is around to help in times of need. Now I can get back on track financially. Thank You Loyal Credit !!"

- Dave

3-Step Process to Open Your Line of Credit Account

Step 1: Submit your Request

Step 2: Get Approved

Step 3: Request a Draw Online

A Line of Credit through Loyal Credit provides you with financial flexibility and a safety net for unexpected expenses that may come your way. Submit a request today – getting started is simple and the process only takes a few minutes to complete.

Checking eligibility won’t affect your credit score. If approved, a hard inquiry will appear on your credit report.

Why Choose a Line of Credit through Loyal Credit?

Quick and Easy Online Application

Applying is quick and easy – and can be done from home or on-the-go. The process is transparent and can be completed in minutes.

Fast Funding

Enjoy fast funding as soon as the same business day so that you can handle emergency expenses with utmost urgency.

Trusted by 15,000+ Customers

Don’t take our word for it – see what customers have to say!

Don't worry, we can help and we can help fast!

STILL GOT QUESTIONS?

Frequently Asked Questions

What is a personal line of credit from Loyal Credit?

A personal line of credit from Loyal Credit is a flexible borrowing option that allows you to access funds as needed, up to your approved credit limit. You only pay interest and fees on the amount you use, not the entire limit.

How much can I borrow with a Loyal Credit line of credit?

You can request a credit limit ranging from $500 to $5,000, depending on your eligibility and credit profile.

How quickly can I get funds after approval?

If you’re approved and request a draw before 3:30 pm ET on a business day, funds are typically deposited into your bank account the same day. Otherwise, funds are deposited the next business day.

What are the eligibility requirements to apply?

To qualify, you generally need to be at least 18 years old, have a valid government-issued ID, an active checking account, and meet minimum income requirements. Additional documentation like pay stubs or bank statements may be requested for verification.

How do I access funds from my Loyal Credit line of credit?

Once approved, you can log into your secure online account and request a draw from your available credit at any time, as long as your account is in good standing.

What is the minimum payment and how is it calculated?

You are only required to make payments if you have an outstanding balance. The minimum payment includes a portion of the principal plus any applicable fees or interest charges, and will be outlined in your periodic statement.

Can I increase my credit limit with Loyal Credit?

Yes, your credit limit may be increased over time based on your payment history and account standing.

Will using Loyal Credit affect my credit score?

Your account activity may be reported to major credit bureaus, which can help you build your credit history if you make timely payments and manage your account responsibly.

Are there any hidden fees or prepayment penalties?

Loyal Credit is committed to transparency. All fees and charges are clearly outlined in your agreement, and there are no prepayment penalties. You can pay off your balance early without extra costs.

+1 XXX-XXX-XXXX

Requests for credit submitted on this website may be originated by one of several Bank Lending Partners, including: XXXX, XXXX, XXXXX, XXXXX,XXXXX/

Our Bank Lending Partners reserve the right to assess your creditworthiness and ability to pay periodically, which may impact how you use your Line of Credit.

A Line of Credit through Loyal Credit is an expensive form of credit and should not be used as a long-term financial solution.

1. Not all requests are approved; duration of approval process may vary. Credit limits may vary and are subject to verification criteria.

2. The exact impact of payment(s) and/or account activity on your Line of Credit through Loyal Credit to your credit score is unknown as your credit score is influenced by numerous contributing factors.

3. If approved, any requested funds will typically be deposited into your bank account the same business day; timing of funding may vary. The date and time the funds are made available to you by your bank are subject to your bank's policies. For specific funding cut-off times, click here.

4. If you have an upcoming due date and would like to set up an Automated Clearing House (ACH) payment, your request must be received by 6:00 PM ET one (1) business day before your due date. Processing of payments are subject to your bank's policies.

5. As you move through your credit journey, your account may become eligible for reduced billing cycle charges and/or increased credit limits based on a good payment history over time. You will receive notices, as applicable, regarding your individual circumstances and eligibility. Eligibility varies by state.

6 If approved, you can request a draw at any time, so long as you have available credit, your account is in good standing, and you otherwise meet any criteria required to request a draw from your account.

Sitemap | Terms of Use | Privacy Notices | Legal

One World Dr Suite 400, Rehoboth, MA 02020, United States